EQ SHAREHOLDER SERVICES’ CASE STUDY | DRAX EMPLOYEE SHARE PLANS | APRIL 2024

Award Winning Approach To Financial Education And Fostering Employee Share Ownership

Summary

Drax Group plc, a global leader in sustainable energy solutions employing 3,400 individuals worldwide, with a significant workforce of 2,500 based in the UK, embarked on a transformative journey to foster employee participation and engagement through an innovative approach to its all-employee share plans.

Drax’s purpose is to enable a zero carbon, lower cost energy future. Drax recognised the critical role its workforce would play in delivering its purpose. With strong commitment to employee share ownership from the Board and senior leadership, Drax partnered with EQ to develop an UK all-employee offering aligned to its purpose and values.

Leveraging EQ’s expertise in employee share plans and engagement, the collaboration resulted in the creation of a tailored share plan communication programme that catered for the diverse needs and aspirations of its global workforce. This included ensuring accessibility and inclusivity across all levels of the organisation, providing educational resources to empower employees with the knowledge to make informed decisions and implementing transparent communication strategies to foster ongoing engagement. As a result of the partnerships between EQ and Drax, the employee share plan successfully enhanced participation and engagement among Drax’s workforce.

Journey – increasing Sharesave participation to record levels

With Drax’s ongoing commitment to employee share ownership they have launched the all-employee Sharesave scheme in the UK annually since 2010. All employees can participate in the company’s share plans either through the LTIP for senior employees, “One Drax” recognition awards for more junior employees, Sharesave in the UK or the recently launched Employee Stock Purchase Plan (ESPP) in North America.

Historically, Sharesave take-up reached a peak of around 47% total participation in 2019. However, since 2019, to ensure maximum appeal to everyone, the focus has shifted to increase take-up amongst the most under-represented groups – the under-30s, and particularly younger women.

A small project team was created to investigate what encouraged and discouraged participation. Key factors included lack of understanding and affordability. As such, communications were redeveloped to make Sharesave more relatable, focusing on how little could be saved (“from as little as £5 a month”), and used simple, accessible, language. Employee advocates were enlisted from each business area and their positive endorsements were included within key messages. Additionally, employee engagement “MyVoice” forums provided valuable feedback to the team.

Redesigned themes and imagery representing the target audience, brought to life the plan and what future values could look like under different scenarios.

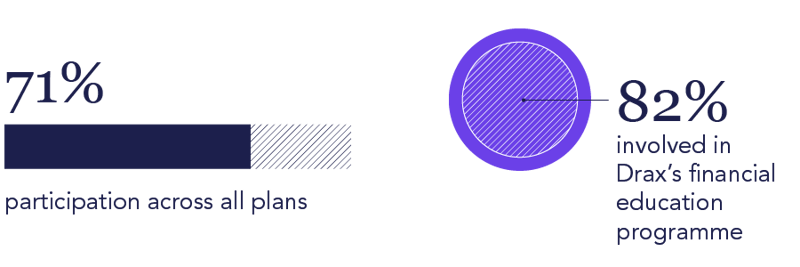

In the first of the re-vamped invitations in 2020, nearly one-third (30%) of participants were new to Sharesave. With these “new” participants, total Sharesave participation across all plans rose to a then high of 57.1%. With on-going focus, participation rates have continued to grow and as at the 2023 grant, total participation reached 71% across all inflight plans – a record level for Drax.

Total participation reached 71% across all inflight plans – a record level for Drax.

Within this, participation by women had grown significantly, from 37.7% in 2019 to 67% in 2023, almost closing the gap with male participation (73% by 2023). Participation in the demographic group with lowest participation (women under 25) has grown from 25% in 2019 to 47% in 2023, reflecting the focus to increase participation in under-represented groups.

Additionally, analysis shows that Sharesave is relevant to all income levels. The split by career level grade shows that (insofar as career level correlates to earnings) participation is high across all income levels. Even across the lowest two levels, average participation is 48%.

![]()

Nigel Youds and his team, along with Colleague Relations, Internal Communications, and members of the MyVoice forums, have joined together as strong advocates of Sharesave and should be congratulated. Clearly their hard work, energy and enthusiasm over many years has resulted in this impressive take-up, evidencing Drax’s commitment to fostering employee share ownership.”

Graham Bull, MD All Employee Share Plans, EQ

Financial education – helping colleagues manage their shares

The high participation rate in 2020 together with an option price set at a low point in the share price cycle, resulted in 2023 being Drax’s largest and most valuable maturity to date.

With a £1.271 option price and gains at maturity of around 333%, the Drax team recognised early on that plans maturing in 2023 were likely to see significant gains. In addition, due to the increase of ‘new’ participants in 2020, around one-third of participants would be experiencing a maturity for the first time.

As a responsible employer, Drax wanted to support colleague financial wellbeing and provide them with all the tools needed to enable them to take the best action when becoming shareholders, many for the first time. WEALTH at Work, a leading financial wellbeing specialist were appointed to develop a best-in-class financial education programme alongside EQ and Drax.

In addition, to help and support employees hold and manage their shares digitally, a Corporate Sponsored Nominee (CSN) was set-up with EQ.

The partnership trio of Drax, EQ and WEALTH at Work provided a “golden triangle” for employee support, with EQ providing employees with a full suite of choices, including transferring shares into an ISA, gifting shares to a spouse/civil partner, selling shares, and holding shares through the CSN.

WEALTH at Work helped to design a programme of events and collaborated with MyVoice representatives as programme advocates. The programme explained ways to reduce CGT liabilities, practical guidance on submitting instructions, information about being a shareholder and receiving dividends, as well as wider financial education covering topics such as financial planning, diversification and having a balanced portfolio.

The multi-faceted approach targeted everyone with a maturing plan and included:

- CEO messages to the business.

- A minute-long “teaser” video.

- A 90-second video introducing CGT.

- In-person meetings at Drax Power Station, along with a series of online webinars.

- A recorded session hosted on the intranet.

- Free one-to-one guidance calls with a money guide with access to specialist guidance from WEALTH at Work.

- A detailed, step-by-step guide, mapping out maturity information for each scenario.

82% of employees participated, and 516 colleagues had a free one-to-one guidance call, ensuring the programme was a success.

Drax's philosophy to foster employee ownership is underpinned by:

- Board recognition and support of the importance of all-employee plans and employee share ownership.

- Long-term commitment (13 years offering Sharesave).

- Employing share plan advocates who continuously look for ways to promote the plan.

- Running effective communication campaigns, making it easy for employees to join and make the best decisions for their own circumstances.

- More recently, providing a financial education programme so employees have a positive experience becoming shareholders.

Result

The success of the Sharesave plan is evidenced by employees’ actions, with Sharesave participation at record levels for Drax (71% across all plans).

Sharesave gains made by employees through the recent maturity show how successful the plan has been in providing employees with significant financial benefits linked to the company’s success.

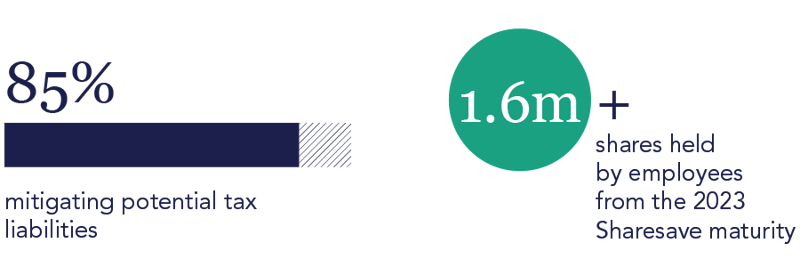

Within the first month of the 2023 maturity:

- 96% (850 colleagues) exercised their option (a few have delayed maturities).

- 85% mitigated paying CGT (through transferring shares to a spouse/civil partner or ISA or selling with gains of less than £6,000).

- 0% elected for repayment!

Through the long-term focus on increasing take-up and comprehensive support at maturity, Drax are achieving outstanding results and fostering share ownership amongst colleagues. This earned them accolades at the 2023 ProShare awards, winning both “best financial education initiative for employees” and “best overall performance in fostering employee share ownership 501 – 5,000 employees”. At the ESOP Centre’s awards in April 2024 they won “best all-employee share ownership plan 2023” and received a highly commended award for “best share plan response to significant changes or challenging situations 2023”. They have also received global recognition, winning the “best in financial education” category at the 2024 GEO awards.

Sharesave headlines

![]()

Sharesave is a great way to share wealth throughout a business, supporting financial wellbeing and longer-term savings and investment good habits. Sharesave is an integral part of Drax’s benefits offering, and it’s been great to see take-up levels increase significantly over time, particularly amongst previously under-represented groups. Many of our colleagues became Drax shareholders for the first time in 2023, in fact becoming shareholders in any company for the first time. We’re proud that the work we started four years ago has turned into such a positive story. We’ve been able to share our experience with other companies, hopefully showcasing what a great benefit Sharesave can be in supporting financial wellbeing and in fostering employee share ownership.”

Nigel Youds, Deputy Company Secretary, Drax

Are You Registered For EQ Bulletin?

We work with experts from across EQ to bring you a summary each month of what is happening within the financial services industry that impacts the share registration and employee share plans space. Register below to receive our monthly update.