Rise Of The Retail Investor

EQ surveyed 2,000 US and UK retail investors. A mix of employee shareholders, direct holders and those who own stocks indirectly. The results show a diverse community of retail investors keen to grow their wealth and exert their influence.

UK shareholders skew younger than US

Number of survey respondents by age

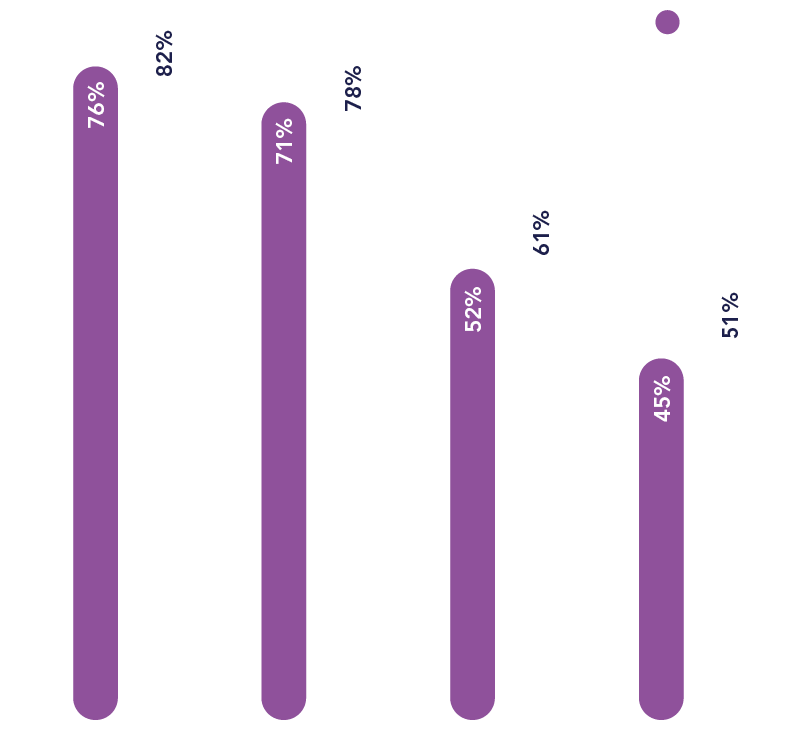

Shares are perceived as more interesting and rewarding than other investments...

Proportion of shareholders who ‘agree’ or ‘strongly agree’ with these comparisons of shares with other investments in their portfolios

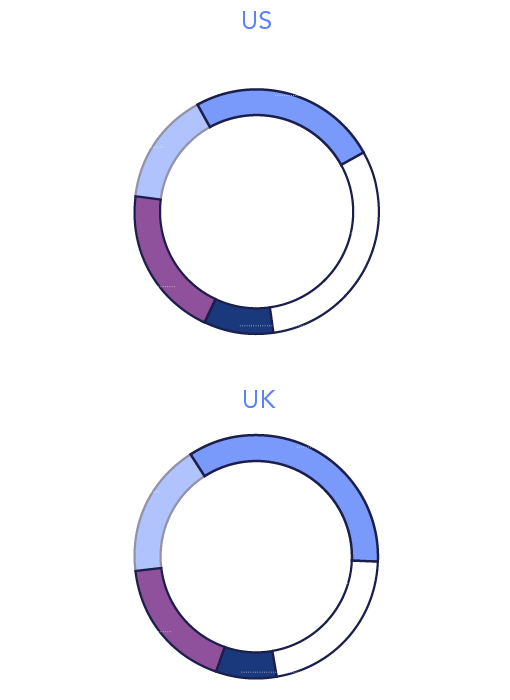

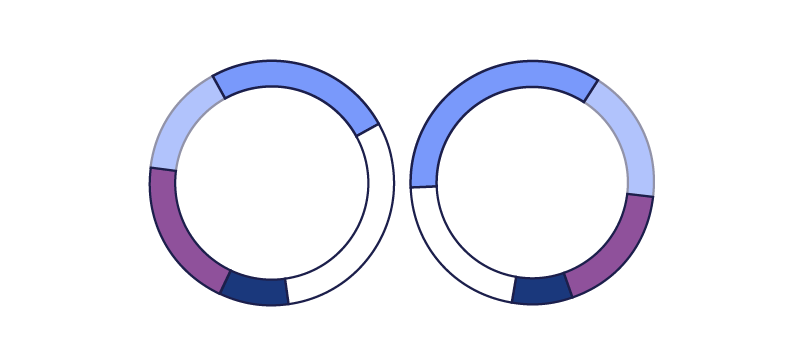

Most shareholders invest through more than one channel

Percentage of respondents of each shareholder type

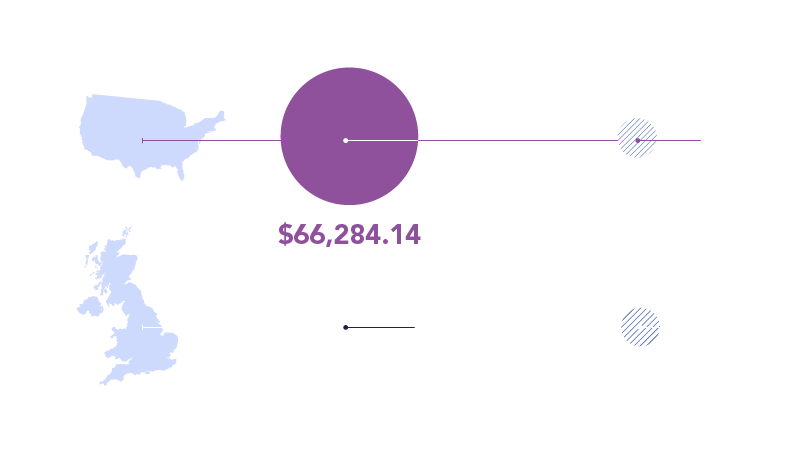

US shareholders tend to invest more and expect higher returns

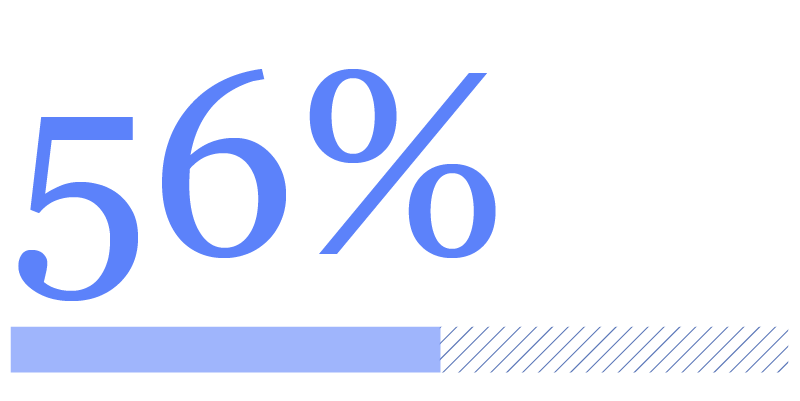

...But shareholders are not putting all their eggs in one basket

of shareholders also have other investments in their portfolios e.g. investment / mutual funds, corporate or government bonds, investment trusts or exchange-traded funds

Company familiarity and short-term gains drive investor decisions...

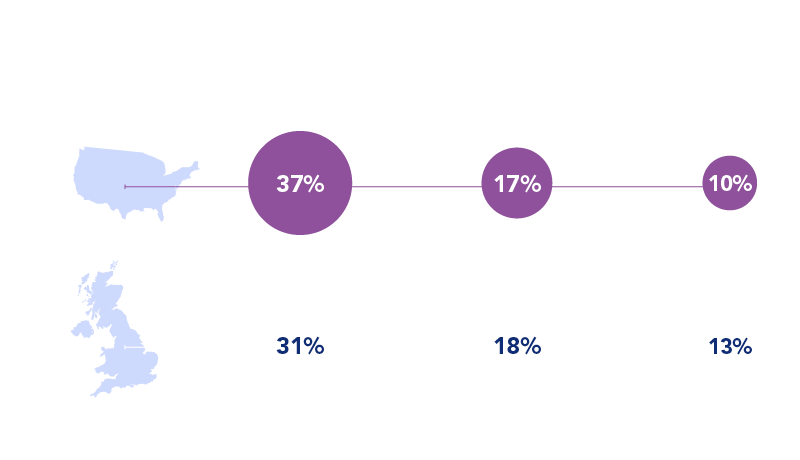

Top three reasons why respondents bought shares in the companies they did

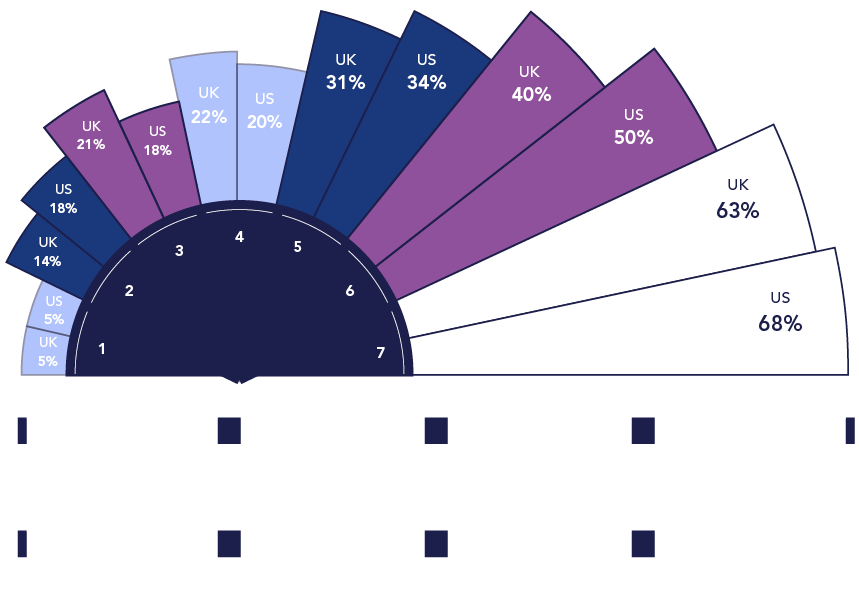

Shareholders want to make their voices heard at AGMs

Percentage of respondents who vote in AGMs of companies they own shares in:

Growing wealth and saving for retirement are key motivators

Percentage of respondents who selected these reasons for why they chose to buy shares

To influence a company to behave differently

To support a company I like

To raise money for a specific purchase e.g. a house, college fees

To pass on shares in my inheritance

For fun or interest

To save for retirement

To grow my wealth

...But a company’s values also matter

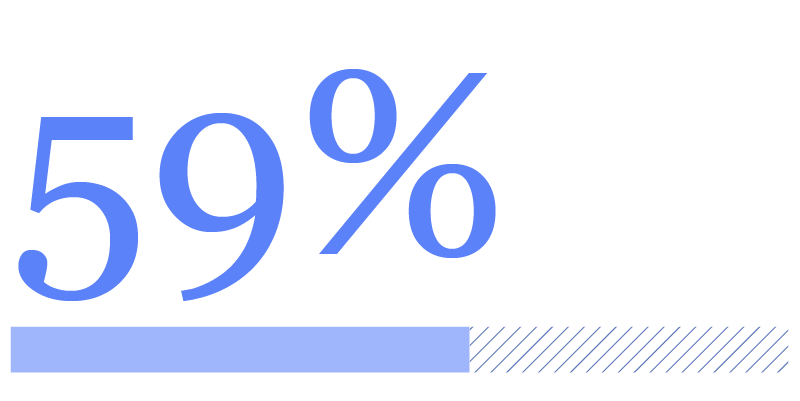

of US shareholders, and 63% of UK shareholders will consider a company’s goals, mission and purpose before choosing to invest

How should you respond to the explosion in the number of retail shareholders?

EQ's Shareholder Voice 2021 report explores the behaviours and motivations of 2,000 retail investors through in-depth research and expert industry commentary.