- £2.5bn of new capital raised in September is the highest single month total since June 2014

- Combined value of money raised in September and October the highest since 2013

- EQ publishes Q3 2020 IPO report: Big IPOs lead the way in US and China, ESG dominates investor’s thoughts

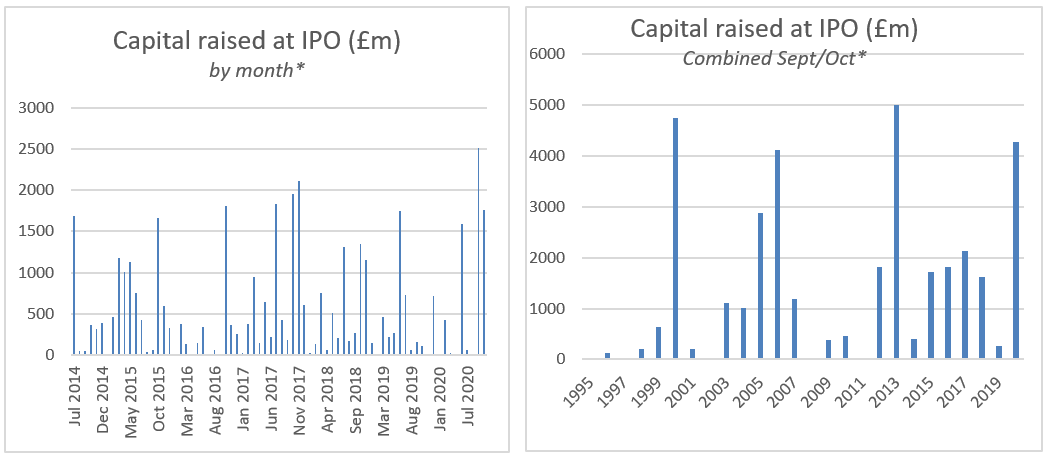

Analysis from EQ (Equiniti Group plc), an international technology-led services and payments specialist, reveals that the £2.5bn of new capital raised at IPOs on the London Stock Exchange1 in September was the most in a single month since June 2014.

Pent up demand caused by the coronavirus disruption meant another strong showing in October sees the combined total for money raised during floats in September and October reach the highest level since 2013.

Data source: New Issues & IPO Summary, London Stock Exchange

The successful large raisings by The Hut Group and international listings from Chinese hydroelectric company, Yangtze Power, and Kazakh bank, Kaspi.kz., have signalled a recovery in the London market, which has been subdued by Coronavirus disruption.

Following September’s large listings, October saw the most companies (11) list since the 13 that floated in July 2018.

In 2020 EQ has acted as registrar on five main market IPOs, including Hut Group and SourceBio International. EQ is now registrar to around half the FTSE 100 and has won four new share registration clients from competitors during the year, including one large FTSE 100 company.

Paul Matthews, CEO of EQ Boardroom, commented: “The London IPO market has been subdued for much of the last two years as investors and issuers grapple with the seemingly endless cycle of geopolitical uncertainty. While the pandemic has undoubtedly suppressed activity further, Autumn’s bounce back is an encouraging sign that we may be turning the corner as quality international and UK companies come to the London market to raise the funds they need to succeed on a global scale.”

Along with these findings, EQ’s share plan and registration, governance and investor relations advisory business - EQ Boardroom - has published its latest report into the global IPO market.

The report highlights international IPO trends and the rise of ESG:

- New York: Tech grabbed most of the headlines, with database software provider Snowflake raising $3.4bn from enthusiastic investors, who doubled its value on debut (to around $70bn at peak, or 175x revenue). While, in the healthcare sector, gene engineers Poseida, molecular profilers Genetron and protein-focused Inhibrx raised over $600m between them, oncologists Nkarta tripled on debut and start-up cell computer modeller Relay Therapeutics raised over $400m.

- Shanghai: Demand from retail investors - who snap up 70% of China’s IPO shares - continues to surge, with 2.4m new trading accounts opened in July alone. The average launch day share rise is 126% even though the mean price to earnings multiple is 85x. Biopharma is getting a particularly enthusiastic welcome: Contec Medical Systems shares, for example, rose a record 1,016% on its first day of trading, having been nearly 5,000 times over-subscribed.

- Good Works - The Growing Importance of ESG in Public Companies: EQ explores the opportunities, issues and challenges ESG presents to companies looking to go public.

ENDS

Note 1: New Issues & IPO Summary, London Stock Exchange

For more information:

Tulchan Communications

Martin Robinson

Tel: +44(0)20 7353 4200

Email: Equiniti@tulchangroup.com

Notes to Editor:

About EQ (Equiniti Group plc)

EQ is an international technology-led services and payments specialist. With over 5,000 employees, it supports 36 million people in 120 countries and serves c.70% of the FTSE 100. EQ’s purpose is to care for every customer and simplify every transaction, delivered with less of an impact on the environment.

EQ is listed on the London Stock Exchange as Equiniti Group plc.

Find out more https://equiniti.com/

EQ serves clients and customers through four divisions:

EQ Boardroom: Share registration, governance and investor relations advisory, and employee benefits services

EQ Digital: Helping regulated businesses and Government to manage customers through innovative digital solutions

EQ Paymaster: Pensions, annuities, flexible benefits and payroll for the UK’s largest public and private sector organisations

EQ U.S.: Transfer agency, equity compensation services and digital solutions for U.S. firms; serving the world's leading brands since 1929