- Average estate leaves behind £69k in cash at death with a total of over £17 billion left each year

- Property the most valuable asset with £43 billion left behind each year, 54% of all wealth to be passed down

- Equiniti urges people to start planning and get their estates in order ahead of bereavement

Analysis from Equiniti Benefactor – the bereavement services business of Equiniti handling more than 55% of all UK deaths – finds that over £17 billion in cash is left behind after deaths in the UK each year, an average of £69k per estate.

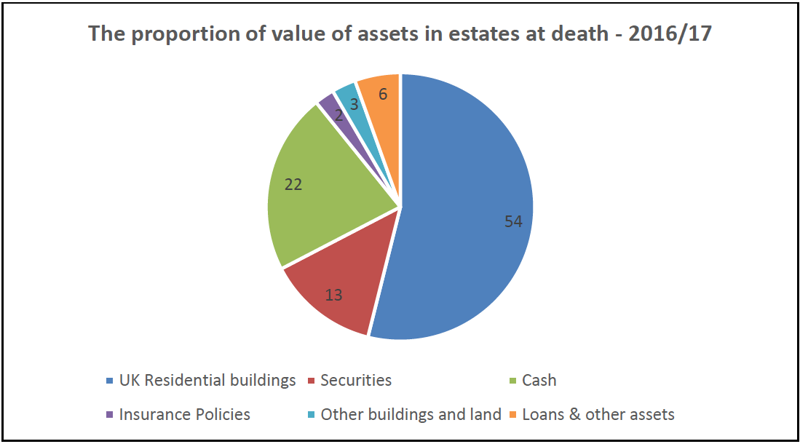

It demonstrates the value that people still attribute to holding money in cash despite the potential for currency inflation to devalue these savings. Securities – typically held as stocks & shares, and bonds – similarly account for a significant amount of the total estate value with more than £17 billion handed down at death each year.

The figures, released last week by HMRC1, also show that property continues to dominate the value of assets at bereavement accounting for 54% of the total wealth – over £43 billion worth of residential housing.

However, property handed down is particularly concentrated among the wealthiest – those with an estate in excess of £2 million pounds passing down housing wealth held an average property fortune of over £1.6 million.

Stuart Simpson, Head of Equiniti Benefactor, believes the figures demonstrate how crucial end of life planning is for people approaching later-life, commenting:

“For estates to be holding nearly £70k in cash at the point of death raises questions about how people are handling their finances in later life. Even through the process of probate, this wealth will be eroded through inflation, while a pot of money held in cash throughout retirement will suffer more serious problems.

“The HMRC figures show that around a third of estates that include a property now break the inheritance tax threshold, demonstrating that estate planning should be a key part of our financial lives. Inheritance Tax can be a nasty shock for those who are not aware of their limits and the fees their loves ones may incur on wealth that is being passed back down to family and friends.

“We would encourage all those entering their later-lives to see a professional financial adviser who can help maximise whatever inheritance they wish to leave behind and ensure peace of mind.”

ENDS

For more information:

Tulchan Communications

Martin Robinson

Tel: +44(0)20 7353 4200

Email: Equiniti@tulchangroup.com

Notes to Editor:

Source:

1. HMRC Inheritance tax statistics, 19 September 2019

About Equiniti Group

Equiniti Group plc, an international technology-led services and payments specialist, provides non-discretionary payment and administration services to some of the world’s best-known brands and UK’s largest public-sector organisations.

It is the UK’s leading provider of share registration, employee share plans, and associated investor services, and also has market leading positions in pension administration and software, and employee benefit schemes.

Equiniti’s services, which are delivered by over 5,000 employees, benefit 36 million people in the UK, US and 120 other countries around the world.

Equiniti Benefactor receives approximately 1,000 notifications of death on an average day, which equates to around 50% of the total number of deaths in the UK each year and manages around 500 estates per year, distributing over £335 million of assets and supporting over 1,200 beneficiaries.