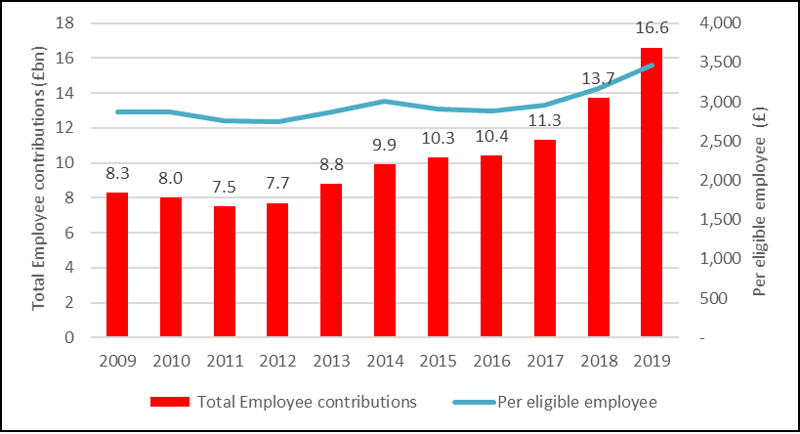

- Private sector employee contributions double to a total of £16.6 billion in 2019 (£8.3 billion in 2009)

- Average annual savings for eligible employees also ticks up to a high of £3,461 as rise in contribution rates kicks in

- EQ encourages savers to stay committed to pensions amid the economic fall-out from Covid-19 crisis

Analysis of DWP figures1 from EQ (Equiniti Group plc), the international technology-led services and payments specialist, finds that employees in the private sector contributed £16.6 billion into workplace pensions in 2019, double the amount compared to a decade ago.

While auto-enrolment has boosted the numbers of employees participating in workplace schemes, these latest figures indicate that the contributions employees are making are now beginning to accelerate too.

In 2019, private sector employees contributed a total of £16.6 billion, double the £8.3 billion saved a decade previously and substantially up from the previous two years with £11.3 billion and £13.7 billion saved in 2017 and 2018, respectively.

Average savings per eligible employees (including employer contributions) have also seen strong recent growth. On average, individuals invested £3,461 in their workplace pension in 2019, up nearly three hundred pounds from 2018 (£3,172) and an increase of five hundred pounds from 2017 (£2,960).

This increase probably represents the impact of the increased minimum contribution rates, rising to 5% in April 2018 and then stepping up again to 8% in April 2019. Previous research from EQ found that occupational pension income is becoming a substantially more important component in later-life, accounting for 30p in every pound of income for retirees.

Duncan Watson, CEO of EQ’s pension business, commented: “These figures represent further reason to be positive about the landscape of later life savings in the UK. Private sector employees are beginning to reap the benefits of auto-enrolment with increases in annual contributions now beginning to catch up with the surge in participation following its introduction in 2012.

“Of course, there is still more to be done in terms of encouraging employees to remain invested in a pension scheme throughout their career and the Covid-19 crisis will likely represent the first key challenge of the auto-enrolment era. We will be watching closely to see if opt-out rates increase as employees are faced with financial pressure and job uncertainty amid the economic fall-out. We would urge employees to keep contributing every month, where possible, to ensure they have a big enough pension pot to support them in their retirement.”

1. DWP, Workplace pension participation and savings trends: 2009-2019

ENDS

For more information:

Tulchan Communications

Martin Robinson

Tel: +44(0)20 7353 4200

Email: Equiniti@tulchangroup.com

Notes to Editor:

About EQ (Equiniti Group plc)

EQ provides accessible digital services for regulated markets. It specialises in equity and investment products, pensions, payments and regtech.

EQ is working to become a business with a stronger purpose. Its aim is to care for every customer and to make its services accessible for everyone, delivered with less of an impact on the environment.

It is the UK’s leading provider of share registration, employee share plans, and associated investor services, and also has market leading positions in pension administration and software, and employee benefit schemes. EQ’s services, which are delivered by over 5,000 employees, benefit 36 million people in the UK and 120 countries around the world.

EQ is listed on the London Stock Exchange as Equiniti Group plc.

About EQ Paymaster

EQ Paymaster is one of the largest providers of outsourced pension administration in the UK, working with schemes in the public and private sectors with complex defined benefit, defined contribution and hybrid arrangements. In addition, EQ also provides specialist pensions savings and retirement income administration services to the insurance sector.