- Median occupational pension savings fall from £106,000 to £71,000 over past two years for those aged 55-64

- Savings for those in the 25th percentile more than halve to £8,500 as reliance on State Benefits appears as a probability for millions

- Equiniti urges people to plan ahead for their retirement and to try and build up savings from as young an age as possible

Analysis from Equiniti, one of the UK’s largest pension administrators, reveals that workplace pension savings have plummeted for Brits close to retirement amid fears that many have saved insufficiently for their later life.

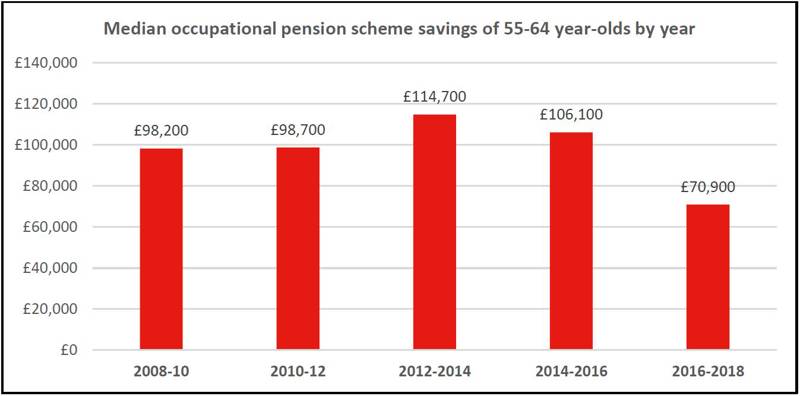

Median occupational pension savings for 55-64-year-olds remained relatively constant between 2008 and 2012, hovering around £98,000 and £99,000 before rising to £115,000 and £106,000 in 2012-14 and 2014-16, respectively.

However, in 2016-18, average savings have collapsed falling to just £71,000 for this age group, decreasing by over 38% or £44,000 since the peak in 2012-14. It raises fears that millions could enter retirement without the means to sustain themselves and leave them relying on State Benefits to cope financially.

The advent of auto-enrolment in 2012 and the introduction of DC pension freedoms in 2015 may also have had an impact according to Duncan Watson, CEO of Equiniti’s pension business, who commented:

“It is alarming to see so many people within ten years of reaching the State Pension Age are looking likely to enter retirement with so little reserved in their occupational pension savings.

“Innovation through auto-enrolment and pensions dashboards will transform the pension industry in this country, but this will be of little comfort for those whom will largely be unable to benefit from the reforms.

“Nonetheless, it should act as a warning light for those just starting out in their careers and on their pension-saving journey. Starting to contribute to a pension is the hardest part in having to sacrifice a chunk of the monthly pay-cheque, but it will become second nature and will make a huge difference to the quality of life people can afford forty years down the line. Your future self will thank you.”

The 25th percentile of pension savers shows an even bleaker picture with at least a quarter of 55-64-year-olds having built up savings of just £8,500 ahead of their retirement, a figure which has more than halved from £20,700 in 2014-16.

While other age groups also saw declines in their median pension savings in this reporting period from the ONS, they were far less startling, especially given younger age groups will still have many more years in their accumulation journey.

The findings also reveal the stark difference between public and private sector savings. Those aged 55-64 in the public sector, and therefore more likely to be in defined benefit pension schemes, have median workplace pension savings of £181,100 while those in the private sector have pots roughly seven times smaller at just £27,000.

ENDS

For more information

Temple Bar Advisory

William Barker / Sam Livingstone

Tel: 078 2796 0151 / 077 6965 5437

Email: williamb@templebaradvisory.com / saml@templebaradvisory.com

Notes to Editor:

Source:

1. ONS Wealth & Assets Survey, Pension wealth in Great Britain: April 2016-March 2018, December 2019

About Equiniti

Equiniti Group plc, an international technology-led services and payments specialist, provides non-discretionary payment and administration services to some of the world’s best-known brands and UK’s largest public-sector organisations.

It is the UK’s leading provider of share registration, employee share plans, and associated investor services, and also has market leading positions in pension administration and software, and employee benefit schemes.

Equiniti’s EQ Paymaster division is one of the largest providers of outsourced pension administration in the UK, working with schemes in the public and private sectors with complex defined benefit, defined contribution and hybrid arrangements. In addition, Equiniti also provides specialist pensions savings and retirement income administration services to the insurance sector.

The wide array of administration services provided include; member record keeping and maintenance; web; treasury; accounts; communications; and pensioner payroll. Equiniti supports around nine million pension scheme members and pays around 20% of UK pensioners, delivering £25 billion in payments to 3.5 million pensioners and annuitants in 2017.