The data used in this article covers the FTSE 100, FTSE 250, FTSE SmallCap, FTSE Fledgling, and FTSE AIM All-Share. The data collected for 2024 covers the year until the 25th of September.

The UK Market

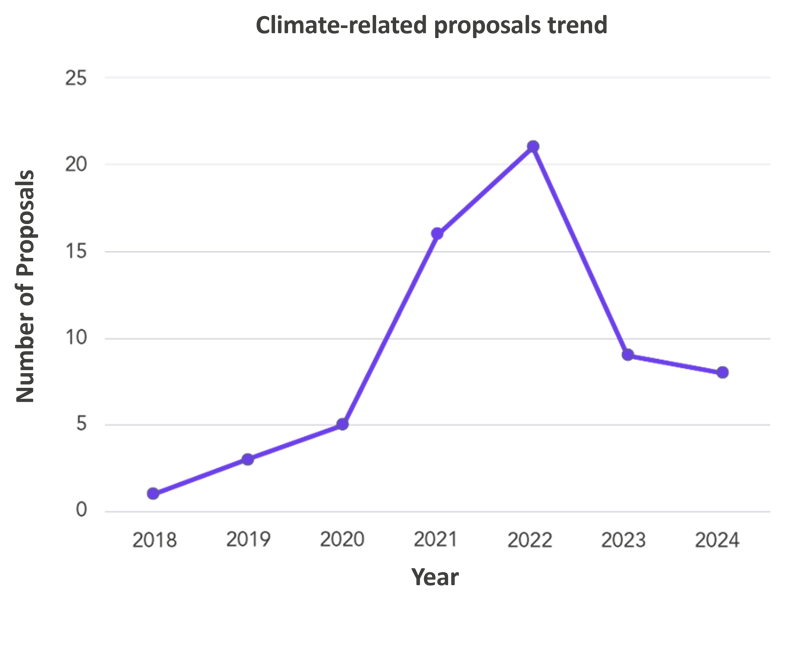

In our previous article, we observed a notable decline in climate-related resolutions, proposed by both shareholder and management between 2022 and 2023. Looking back on 2024, at this point it’s clear that these proposals continue to fall short of the 2022 peak, remaining at levels comparable to those of 2023.

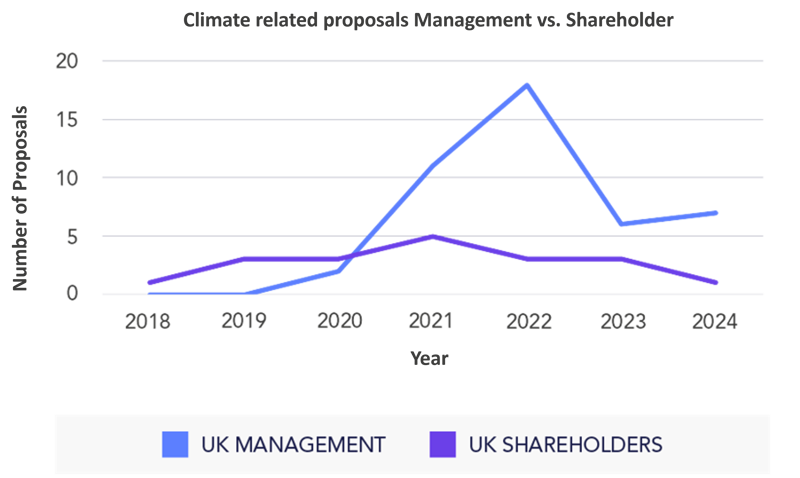

Splitting this trend by Management and Shareholder proposals, both have declined in recent years. Shareholder resolutions have seen a gradual decline from a lower peak, while Management resolutions have dropped significantly in the space of a year.

Daniel Kehoe, Senior Research Analyst on ESG Shareholder Resolutions at Minerva Analytics LTD states that “the sparse number of climate proposals may have stagnated in the UK as shareholders have seen substantial profits in the energy industry in recent years, with BP plc reporting profits of approximately $15.2 billion in 2023 and Shell plc posting profits of around $22.2 billion. This financial influence appears to have refrained shareholders from their climate efforts. As seen recently at the Shell plc AGM, where the recent Follow This proposal received only 18.06% support, in contrast to its peak of 29.43% votes in favour in 2021.”

Another potential reason for the decline in climate-related proposals is that shareholders are increasingly holding directors accountable for ESG issues by opposing their re-election. This is an emerging theme we have identified in investor voting policies in 2024. For example Legal & General Investment Management state in their 2024 UK Corporate Governance and Responsible Investment Policy, “Companies that fail to meet our minimum standards with regard to climate disclosure will be removed from select funds, including our Future World funds, subject to tracking error constraints. In all other funds where we cannot divest, we will vote against the chair or other directors, to ensure we are using one voice across our holdings.” In their 2024 Voting Policy, Rathbones state “Rathbones will oppose the re–election of the Chair and Lead Independent director, when a company has repeatedly failed to address climate change through the setting of targets and or, appropriate governance and failed to respond to engagement efforts. Rathbones will then escalate to vote against the entire board (incumbent directors only) after two consecutive years of votes against the Chair and Lead Independent director on climate grounds.”

In 2024, we have seen these voting policies implemented and votes against director re-elections materialise on the grounds of failure to meet standards on ESG practices and reporting, from both Legal & General Investment Management, Rathbones, and many more. This suggests that the decline in climate related resolutions proposed does not reflect disinterest in the topic; rather, it signifies an evolution in the methods shareholders are using to hold the Board accountable.

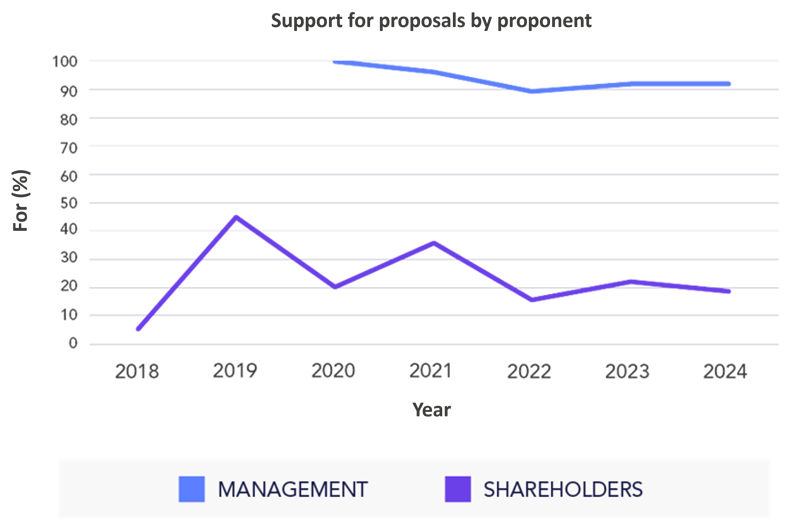

Support for climate-related resolutions has remained consistent, with shareholder proposals typically receiving around 20% support, while management proposals receiving slightly above 90%.

Industries

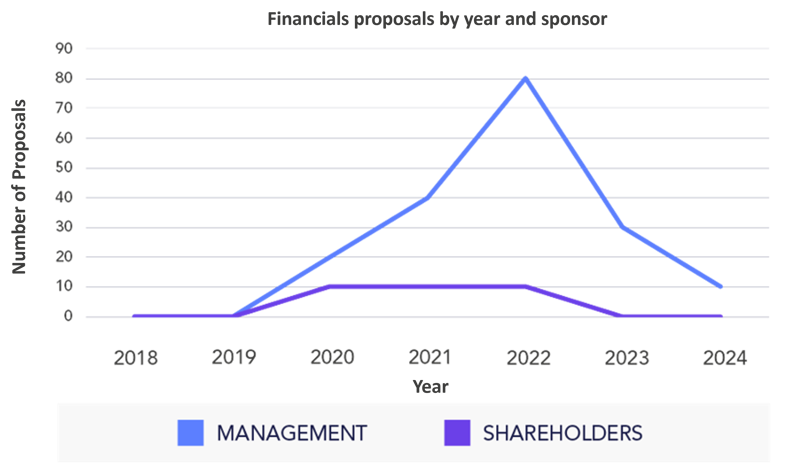

In 2024, the focus by financial institutions on climate-resolutions has further diminished, with only one resolution recorded in our sample: the approval of Ninety One Group’s Climate Strategy, which garnered 97.8% shareholder support.

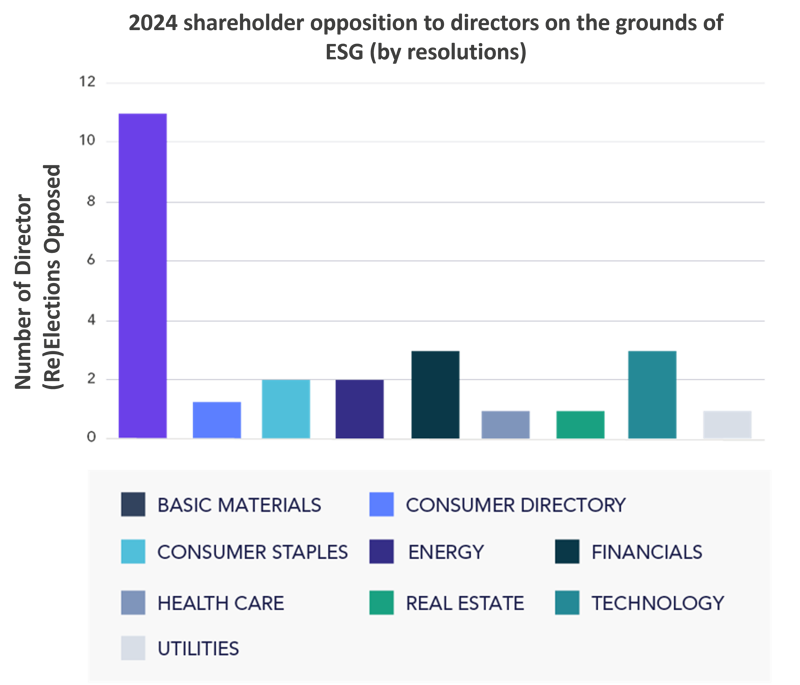

The decline in climate related resolutions may stem from shareholders holding directors accountable and opposing their re-elections. We have analysed resolutions where directors have received opposition on ESG grounds and categorised them by industry, as displayed below.

As expected, the Basic Materials industry is where ESG matters most significantly influence votes against a director’s election. However, ESG factors are increasingly relevant across many industries.

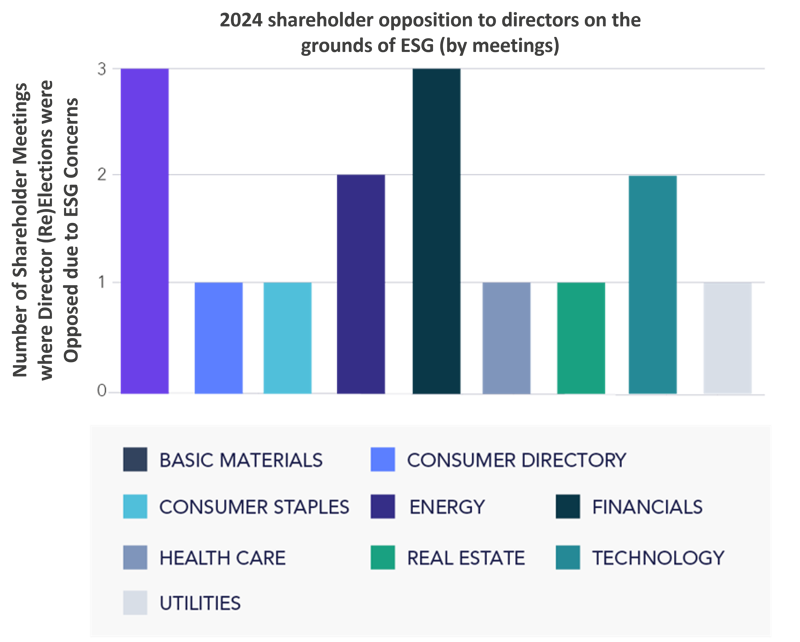

Notably, in companies such as Basic Materials, where environmental issues are at the forefront of their activities, companies more commonly have board level Sustainability Committees. Where this is the case, shareholders will often hold the members of these committees accountable when they have concerns over sustainability practices. Thus, when looking at resolutions where directors have been held accountable for sustainability issues, these companies will be over-represented. Below, we have organised shareholder opposition by meeting, rather than by resolution, revealing that ESG concerns are pervasive across industries.

Our data suggests that director accountability for ESG issues is consistent across many industries, and may become a larger voting issue at companies where they are particularly relevant.

Why is it important to understand the trend in climate-related resolutions?

Understanding the trends in climate-related resolutions will allow companies to better understand the interests of their shareholders, thus enabling them to better prepare to achieve alignment with shareholders on climate issues. Given the dynamic nature of the ESG landscape, it is crucial to engage with shareholders and remain proactive in taking all stakeholders on the entity’s journey.

As 2025 approaches, the significance of ESG reporting is expected to grow.

- The International Sustainability Standards Board (ISSB) published global standards on sustainability disclosure and the UK Government is consulting on plans to introduce these requirements for UK-listed companies.

- The FCA have announced that once the UK endorsement is completed, it would consult on amending its rules to move from TCFD to UK-endorsed ISSB disclosure standards and strengthening its expectations for listed companies’ transition plan disclosures.

Conclusions

The data from 2024 incorporated into our research indicates a changing landscape for ESG matters. The decline in climate-related resolutions should not be interpreted as declining interest in ESG. As this field continues to evolve, so too will the methods shareholders use to engage with companies and hold them accountable. The opposition seen in director elections on the grounds of ESG concerns is the latest step in embedding ESG practices into the UK market. We will continue to monitor these trends as this narrative unfolds.

Find out more

Equiniti provides proxy solicitation services to rally shareholder support at AGMs, General Meetings, and as part of M&A activity. Whether a result of activism, stricter corporate governance requirements or tighter regulations, we can help you respond confidently.