So, what did we see in during 2021 AGMs?

The Investment Association, Pensions & Lifetime Savings Association (PLSA) and Glass Lewis were amongst those highlighting that executive remuneration should take into account whether the company had taken advantage of government funded Covid-related financial assistance and also the workforce experience. This left some remuneration committees in a dilemma as to how to reward and motivate those executives who worked hard during the pandemic to keep businesses going but where company performance may have been adversely affected.

Generally, remuneration committees were urged to ensure that remuneration outcomes took account of both shareholders and wider stakeholder experiences during a difficult year.

Remuneration policy – average vote in favour

The average vote for the remuneration policy decreased across the board with the average vote falling below 90% in favour for FTSE 100 companies for the first time. The number of companies receiving over 90% in favour of the remuneration policy report also fell from 2020.

Annual Report on Remuneration

The number of companies receiving 90% and above actually increased slightly over 2020 and 2019. Many companies have made efforts in recent years to address investor concerns over executive pay in terms of excessive bonus pay outs and pension contributions and to engage with shareholders and explain fully reasons behind pay outcomes.

Average percentage of votes in favour of annual report on remuneration

Average votes in favour of remuneration reports fell for FTSE 100 and other companies whereas the average vote in favour for FTSE 250 companies increased.

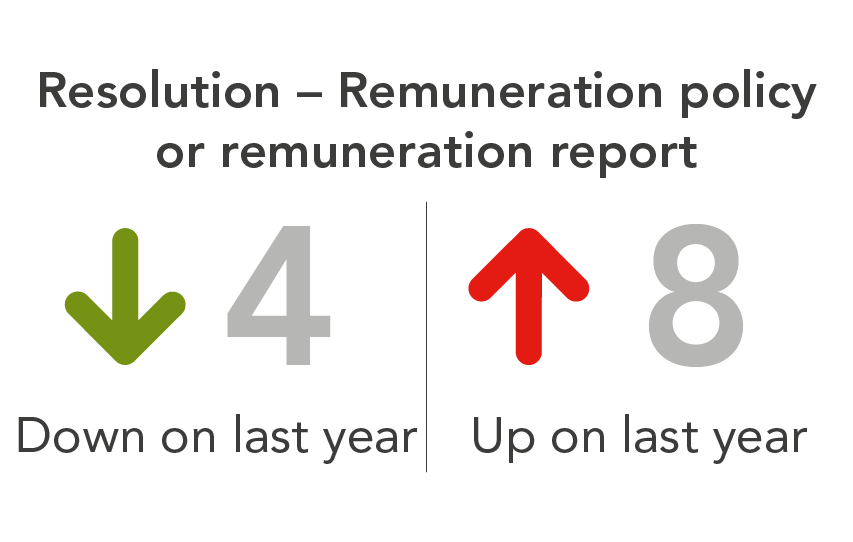

Remuneration resolutions – lost and close call

The number of lost remuneration policy or report resolutions decreased over last year perhaps reflecting the move by companies to tackle other contentious issues such as the alignment with executive pension contributions with the workforce. However, the number of close call resolutions increased from 4 to 8. Our analysis showed that these were often in cases where investors felt directors’ pay outcomes were not appropriate given the impact of COVID on company performance.

The indication that remuneration remains one of the key concerns for shareholders is reflected in the number of companies that regularly receive the lowest votes out of all their resolutions for a remuneration policy, annual remuneration report or share plan. Only resolutions re-electing directors have more resolutions receiving the lowest votes for than the resolutions connected with executive pay.

Top Tips for 2022

- Engage with stakeholders to explain your rationale and any changes to previous years.

- Include robust disclosure in the proxy statement and the rationale for changes, whether it’s a bonus or there’s been a reduction in salary base pay, is key to gaining shareholder support.

- Consider if a higher proportion of bonus payments should be deferred into shares.

- Ensure grant sizes and ongoing performance conditions are appropriate to the current market environment and shareholder alignment.

About the statistics

- Unless otherwise indicated, statistics quoted in this article are taken from research undertaken by Equiniti’s AGM team. The statistics include all companies in the FTSE 100 and FTSE 250 indices as well as Equiniti clients outside of these indices (referred to as other/smaller). All 2021 statistics are for the 2020/21 year ended on 31 July 2021.

- Statistics based on Equiniti clients only.