We explored how alignment between companies and their shareholders on this topic can be achieved and what the future could look like. Since then, we’ve seen publication of the updated Investment Association’s (IA’s) Principles of Remuneration, the UK government’s Employment Rights Bill and the first budget under the new Labour government.

In this changing environment, we’ve been considering the additional flexibility this could offer. Anne-Marie was delighted to speak with Katie Kenny, Partner from Deloitte and panel member, together with Jennifer Rudman, EQ’s industry director for employee share plans.

Firstly, we will focus on the updated IA Principles of Remuneration.

EQ: Katie, at the EQ conference we were waiting for the updated IA Principles of Remuneration to be published. These were issued the following week, on Tuesday 8 October. What have been your initial observations?

The revised IA guidelines were long anticipated and are the latest step on the journey that we have been seeing towards a more flexible executive remuneration environment. This journey started with Julia Hogget’s (CEO of the London Stock Exchange) speech back in May 2023 which called for a ‘big tent’ conversation on the role of pay and governance in the competitiveness of the UK listing environment and has continued through the work of the Capital Markets Industry Taskforce.

The revised IA guidelines are the result of significant consultation with a range of stakeholders including on the issuer and shareholder side and the tone has substantively changed with additional importance given to their purpose as ‘guidelines, not rules, seeking to foster good practice, alignment with investor expectations and support a competitive market environment’.

A number of the underlying provisions with the guidelines remain unchanged and the IA has been clear that the existing market remuneration ‘blueprint’ is likely to remain appropriate for many businesses but there is an increased recognition that it doesn’t work for all and there is much more flexibility within the guidelines for companies to consider remuneration arrangements on a case by case basis where there is a compelling commercial rationale to do so.

There is also new guidance around the use of ‘hybrid’ (combined performance and non-performance) LTIP structures, positive discretion, dilution and quantum which all represent a step in the right direction towards providing companies with more flexibility to design remuneration arrangements which support their business and talent strategies.

From EQ Proxy Solicitation’s perspective, we have already experienced issuers considering and changing elements of their Remuneration Policies being presented for approval.

EQ: Jennifer, from the all-employee share plans perspective, there were three particular areas you highlighted; one being dilution, secondly the timing of grants, and finally the 10-year renewal period for SAYE schemes. Can you tell us more about these changes and what this could mean?

Firstly, on dilution, the overall limits remain, so where ordinary shares are issued under all the company's share schemes (both discretionary and all-employee), the number of new shares, or re-issued treasury shares should not exceed 10% of the issued ordinary share capital (adjusted for share issuance and cancellation) in any rolling 10-year period.

What’s changed is the removal of the restriction on executive (discretionary) schemes, which previously limited this to no more than 5% of the issued ordinary share capital in any rolling 10-year period.

The lifting of the earlier 5% limit on discretionary plans provides companies with additional flexibility on how to apportion the pot of available new issue shares. Companies monitor their share plans to ensure there are appropriate levels of shares available to satisfy awards and options as they vest.

The company’s ‘headroom’ policy looks at how the shares may be sourced through a combination of new issue shares (including Treasury Shares) and the use of an Employee Benefit Trust. In light of this change, companies are likely to revisit their existing policy and the apportionment principles, with a possible shift in the number of new issue shares used for discretionary plans versus all-employee plans. Plan rules may also be reviewed to determine whether these updated dilution principles should be reflected within those rules.

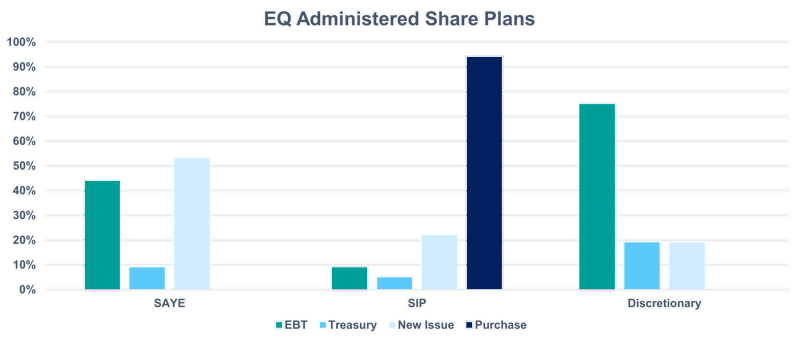

This change could impact how shares are sourced. EQ has looked at the plans it administers and where shares are sourced, with the graph below showing the current position. It will be interesting going forward to see if there is a shift with more new issue and Treasury Shares allocated to discretionary plans.

Secondly, the principle that awards should normally be granted within a 42-day window following the announcement of the company's results (or other exceptional events that may affect the share price) no longer directly applies to SAYE schemes. This helps, as in practice many SAYE rules require the invitation date to be within the 42-day window, meaning the grant date was often outside of this timeframe.

Finally, on the scheme’s 10-year renewal period, this no longer applies for all-employee share plans. So, it’s likely we’ll see more flexibility emerging in this area with updates to scheme rules as they come up for renewal.

Moving on to the next changes we have seen, in October, we saw the Employment Rights Bill announced.

EQ: Katie how do you expect this to be brought into the Remuneration Committee agenda?

The Employment Rights Bill represents the most significant change in worker rights in a generation and Remuneration Committees are going to be looking to understand the impact on company policies, the impact on costs and the risks it creates for the business. Substantive change however also provides opportunities and Remuneration Committees will want to understand how being forward thinking in these areas could create a competitive advantage.

We are also expecting the Equality (Race and Disability) Bill to be tabled shortly which is expected to include mandatory Ethnicity and Disability pay gap reporting. We have had Gender Pay Gap reporting in the UK since 2017 which has significantly elevated the conversation around diversity and inclusion with Committees regularly discussing the pay gaps and the programmes being put in place to address these. We expect to see the conversations broaden to include ethnicity and disability in the future.

Finally, I’d like to turn to the budget announced by the UK government in October 2024.

EQ: Katie, with budget announcements and changes, what are Remuneration Committees going to need to consider?

The budget changes are significant for employers and there are many points which companies are going to have to work through over the coming months. The most immediate decision point for many businesses is likely to be the impact of the Employers NI changes on salary budgets for 2025. Prior to the budget we surveyed clients on what their salary budgets were likely to be for 2025 with most saying that they were planning for a 3 - 4% increase. This is lower than 2024 where the median increase was 4%, reflecting easing inflation pressure, but still higher than typical pre-pandemic levels. The Employer NI rate increase and the lowering of the threshold, along with the slightly higher than expected National Living Wage increase is going to put pressure on many businesses and we would expect companies may lower their salary budgets for 2025 to help manage cost.

EQ: Jennifer, have there been changes announced that will or could impact on employee share plans?

The Employers NI change means that plans such as tax advantaged Share Incentive Plans (SIPs) will increase Employers NI savings as employees contribute to Partnership shares from pre-tax salary. So, it’s a good time to reassess their benefits.

Elsewhere, although unlikely to have much of an impact, the increase may mean some companies with executive share plans consider whether to transfer employer’s NIC to the employee.

The increase in the main rates of Capital Gains Tax (CGT) impact share plans in a variety of ways. Gains on the disposals of tax advantaged Company Share Option Plan (CSOP) shares will be at these higher rates.

Gains on the disposals of tax advantaged SAYE shares will also be at the higher CGT rates. However, the benefits from transferring shares to an ISA or pension continue. This means that it is more important than ever to provide financial education to employees at SAYE maturity, so they know how to mitigate CGT.

Gains on the disposals of Enterprise Management Incentives (EMI) shares are subject to Business Asset Disposal Relief (BADR). The rate for BADR will increase gradually, to give business owners time to adjust to the changes.

Whilst shares held in a SIP are sheltered from CGT, providing an even greater way to hold shares in a tax efficient way.

Some of the other impacts are detailed in EQ’s October 2024 share plans update.

With thanks to Katie Kenny and Jennifer Rudman for sharing their thoughts and expertise.

Discover more about how EQ supports issuers with employee share plans

Gaining shareholder support can be best achieved through engaging with shareholders, and EQ proxy solicitation services support issuers each day with valuable corporate governance expertise and shareholder engagement advice to secure maximum support levels. Contact us for further details.