Due to their autonomous operating nature, proxy advisors are able to digest and evaluate lengthy and complex filings on common corporate events, including mergers & acquisitions, executive remuneration, and more.

As well as providing proxy research, following their review of complex filings and high volumes of data, proxy advisors are able to provide research to support their clientele in these following areas:

- Environment, social, and governance (ESG)

- Proxy voting

- Executive compensation models

- Board diversity

The four main proxy advisory firms in the UK are namely:

- Institutional Shareholder Services (ISS)

- Glass Lewis (GL)

- Institutional Voting Information Service (IVIS), part of the Investment Association (IA)

- Pensions & Investment Research Consultants (PIRC)

How do the Corporate Governance team in EQ Advisory support?

The Corporate Governance team in EQ Advisory supports its clients, as one of their appointed advisors, through providing a proxy advisory report review and rebuttal service.

Our value add in this process is through being able to efficiently review proxy advisor reports for data accuracy, application of their policies and identify areas that are open to rebuttal.

What does success look like for an issuer?

For issuers, success is measured by the receipt of supportive recommendations for their management proposals at either annual or special meetings from these proxy advisory firms. Importantly, having gained positive recommendations, the focus is on ensuring investor and shareholding voting delivers the needed number of votes to approve the proposals.

Why is this relevant?

This delivery of successful proxy advisor management service and advice, which in turn delivers the receipt of a good outcome at the issuers’ annual and special meetings, is relevant because it takes proactive identification of potentially contentious matters coupled with good advance planning to ensure that the outcome sought is achieved.

One of the tasks undertaken by the Corporate Governance team in EQ Advisory, in supporting a company with its proxy advisor management, is to analyse the share register to determine what proxy advisors their shareholders use and their level of dependency on their proxy reports and recommendations. This enables the EQ Advisory team to formulate strategies, through our vote projections, on proposals that have been identified as likely contentious, to bring about a successful outcome at voting on the proposal(s).

What levels of success have EQ delivered?

At EQ Advisory, we do not shy away from putting forward well-reasoned arguments in instances where we believe that proxy advisors have discounted pertinent publicly disclosed information or where there are disparities in the application of their policies.

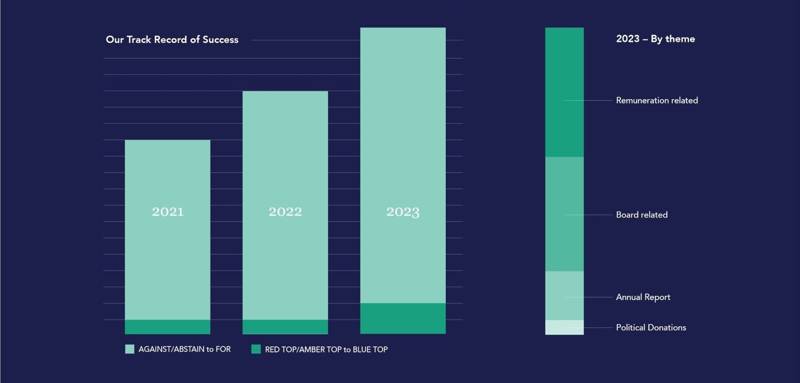

Analysing our success over the period 2021 to 2023 - as shown in the infographic produced by the Corporate Governance team in EQ Advisory - we see increased levels of success achieved over the period. Whether that be in overturning against and abstain recommendations to a ‘FOR’ from the main proxy advisors, or a Red Top /Amber top to a Blue Top in IVIS reports. For 2023 this covers a range of resolution types, notably Annual Reports, political donations, remuneration-related and board-related resolutions.

Proxy Advisors - Our Success on Changing Recommendations

Conclusion

The takeaway here is that it is advisable to expend the effort of reviewing proxy advisor reports for accuracy and rebutting negative recommendations. And as can be seen, through our support, issuers have received changed recommendations across all proxy advisors.

There are many ways in which EQ supports clients with the stakeholder group of proxy advisors, and this is just one example. EQ works proactively with companies to achieve positive results, utilising in-depth research and shareholder engagement to secure the best voting outcomes possible from annual and special general meetings.

Contributors: Olayinka Agbede, Patricia Aizpurua, Anne-Marie Clarke – from the EQ Advisory Team

For further information, please see the EQ Advisory Proxy Solicitation Services website.