According to the Wall Street Journal, 2021 is the ‘Year of the Individual Investor.’ A combination of low interest rates, lockdown boredom, commission-free trading apps and greater volatility in financial markets during the pandemic has resulted in an explosion in the number of retail stock traders in the US and UK.

With with 46% of participants revealing that they own shares in the company they work for, the research provides valuable insights into the effective management and communication of share plans for years to come.

Importantly, the report also explores the impact of Generation Z (employees and investors currently aged 18-24) and millennials (aged between 25 and 40).

These are now the dominant workforce generations but they tend to stay with employers for shorter periods. There is therefore much to be gained from making share plans available to employees as quickly and easily as possible, and encouraging them to retain shares even when they move employer.

— Jennifer Rudman, EQ Industry Director, Employee Share Plans

Making Share Plans Easy

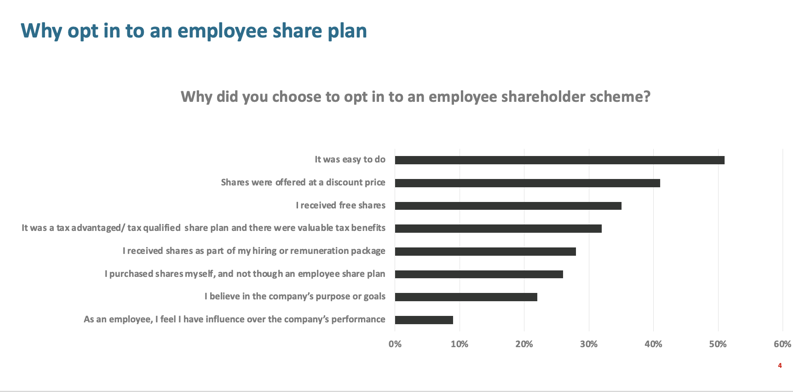

So what does the research, previewed at this year’s ProShare Conference, tell us about why employees take up share plans? The most popular reason is simply that it’s ‘easy to do’.

However, the research also shows that being offered free shares or shares at a discount, and receiving tax benefits are key motivators. And, although the study shows that smaller percentages are attracted by a belief in the company's goals or having influence over the company's performance, these remain important factors.

Why Did You Choose To Opt In To An Employee Share Scheme?

When it comes to choosing which company to take shares in, either as an employee or as a consumer, the main driver is familiarity. That’s followed by confidence that the share price will rise and the prospect of receiving dividend income.

When it comes to choosing which company to take shares in, either as an employee or as a consumer, the main driver is familiarity. That’s followed by confidence that the share price will rise and the prospect of receiving dividend income.

Why You Chose To Buy Shares In The Specific Companies You Own Share In

Interestingly, however, almost a quarter of those surveyed said that they took shares because they wanted to exert influence in changing the company’s behaviour. “According to research from Bank of America, Generation Z are poised to become the most disruptive generation ever, with the economic firepower to back up their convictions,” says Jennifer. “By 2030, they will account for over a quarter of global income and their earnings will eclipse those of millennials.”

It’s therefore essential that organisations keep pace with these trends by communicating to all employee shareholders in ways they can relate to, making the most of digital channels and encouraging brand advocacy to peers and across social media.

Creating Shared Desire

“One of the great benefits of employee share schemes is that they encourage a sense of belonging in the business, and a shared desire for success and getting employees involved in company strategy,” says Jennifer. “This is particularly useful with global or diverse companies because it helps to make everyone feel part of the same team.”

This was reflected in the frequency with which employee shareholders check their share prices – 83% check at least monthly and, of those, 44% check weekly and 20% every day.

How Often Do You Check The Performance Of Your Shares

And as for the overall employee shareholder experience, 85% either agreed or strongly agreed that it’s a positive one. EQ also asked employees whether the experience of owning shares made them feel like they would buy shares in other companies in the future. Again, there was a very positive reaction with 75% saying yes.

“This suggests that companies could offer a variety of choices at plan maturity and vesting, such as holding shares in individual savings accounts and investment accounts so that employees can diversify their investments,” says Jennifer. “This then prompts discussion around how much companies need to do to intensify employees’ financial education, and raise awareness about their equity ownership.”