What are Image Survivable Features (ISF), and how can they improve the security of Dividend and Corporate Action cheques?

In 2017, UK banks introduced the Image Clearing System (ICS) for processing cashed cheques. A key element of ICS is automation with customers now able to pay in cheques by simply uploading a photograph of their cheque to their mobile or online banking service and with cheques now scanned to improve processing and clearing time. However, the removal of the need to present physical cheques introduced a new opportunity for cheque fraud, with cheque fraud losses increasing in 2019 to £53.6M (+161%) and evidence showing that fraudsters are primarily targeting high-value corporate accounts.

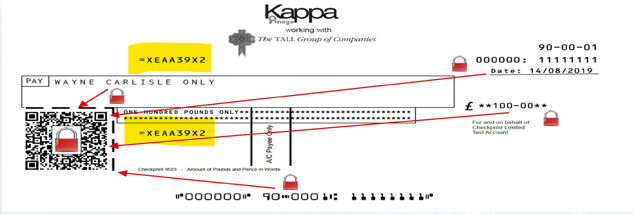

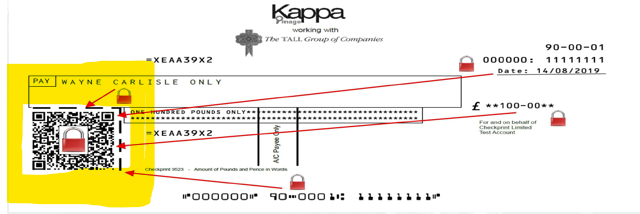

Image Survivable Features are security marks or images on cheques that remain visible and legible after scanning. Equiniti has worked with our security printer to develop an ISF solution that encrypts key cheque data on each unique cheque, providing a robust and comprehensive method of cheque fraud prevention. In simple terms, if the encrypted cheque data within the ISF does not match the information printed on the rest of the cheque, a suspected fraud attempt has been detected and prevented.

Where will ISFs appear on cheques?

There are two types of ISF: UCN and UCN+ (UCN stands for Unique Coded Number).

UCN will appear as a line of encrypted text on all cheque reissues.

UCN+ will appear on all cheques produced in bulk, such as for an initial dividend payment, as a QR code. These cheques will also include UCN as a line of encrypted text.

How much will this extra security cost issuers?

The costs associated with the introduction of ISF are being met by the banks, so there is no additional cost for issuers.

When will ISF appear on cheques?

From Monday, 6th June 2022, all cheques drawn against Lloyds, HSBC and NatWest/RBS bank accounts will have ISF printed upon them. The new designs will be incorporated within document proofs after this date.

Whilst Barclays does not currently support ISF, we are following their Auto Positive Pay procedures in which we share with them detailed information about the cheques we produce on their bank accounts to enable them to better verify the cheques that are presented. We are working with them to also introduce ISF at a later date.